‘Dodged a bullet’: How fall of SVB is affecting First Coast companies (First Coast INNO) — Right up until Silicon Valley Bank’s collapse on Friday, the tech- and bio-startup-focused bank was still working on acquiring new customers and businesses, including on the First Coast.

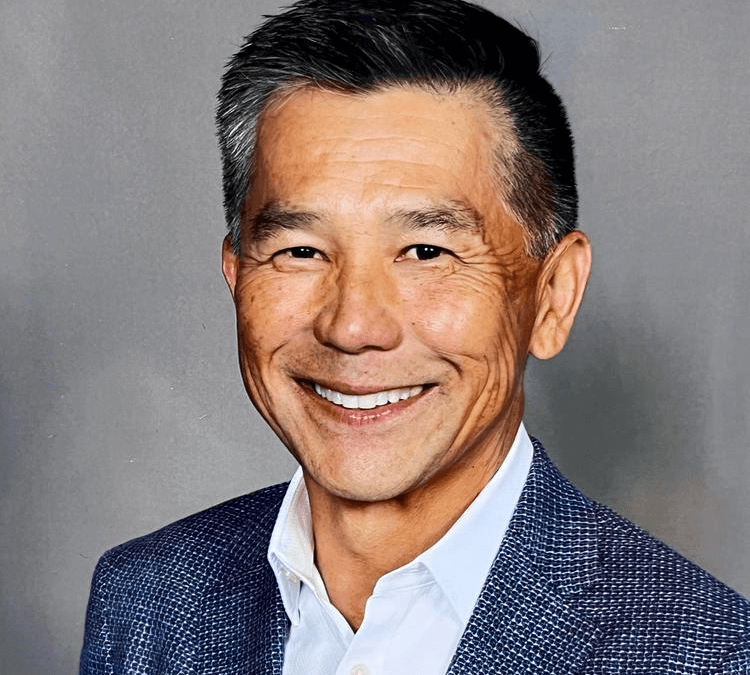

Entrepreneur Quang Pham said Tuesday that his Ponte Vedra-based Cadrenal Therapeutics Inc. (pictured above) was nearing the end of a nearly year-long process that would have seen the newly IPO’d company move it assets to the bank, where about half of U.S. biotech companies parked their money.

“It was going to be an all-in scenario for us,” Pham said about the negotiations. “As recently as last week, we were getting the documents ready and finalizing this deal.”

Then the news dropped: Regulators seized the bank, have appointed a new management team and the bank’s parent company is looking for a buyer.

“Once again, I’ve dodged a bullet,” Pham told the Business Journal in a video call Tuesday morning.

Pham, now on his this third venture, listed instances like when he was a Marine pilot during the Gulf War, his first business coming out of the dot-com bust in the early 2000s and the banking crises in 2008 as other times he and his companies have narrowly dodged an impending crises.

The collapse of SVB and New York-based Signature Bank sent shock waves through the financial and tech sectors: Over the weekend, as Florida entrepreneurs in the lifesciences and bio-medical startup space left the Lake Nona Impact Forum, which focuses on health care innovation, attendees’ conversation focused on funding options, alternative banking solutions and their pending liquidity crises.

Meanwhile, the effects on the First Coast has been more muted.

While Cadrenal was on the verge of becoming a client, and Ponte Vedra-based Treace Medical Concepts kept some funds at the bank, local exposure to the failed banks was not widespread.

That’s not likely to change any time soon.

Although SVB’s new management team has insisted the bank is still open for business, many — including Pham — are balking at the option to continue or begin a relationship.

“We’ve heard from them since Friday, and they called to tell us ‘we’re not gone yet. We’re still here,'” he said of the conversation. “I was just like, ‘no, no, no thanks.’ I wish them, and everyone that helped us through the process, the best, but in the end, I have to look out for what’s in our best interest.”

A local company with some exposure to SVB is Treace Medical Concepts Inc. [NASDAQ:TMCI], which on Friday alerted investors to their exposure, which they said was negligible, in an 8-K statement filed with the Securities and Exchange Commission.

“Treace currently holds over 90% of its cash, cash equivalents and marketable securities at a large US banking institution that is unrelated to Silicon Valley Bank,” the company said in its filing. “[Treace] does maintain operating accounts with SVB; however, given the minimal exposure to SVB, the [Treace] does not believe the current situation with SVB will have a material effect on its financial condition or operating plans.”

Treace was authorized for a PPP loan from SVB in November 2020 for about $1.7 million, according to records from the Small Business Administration. Ponte Vedra-based Reddress Usa Inc, a medical services provider, and Jacksonville-based Polar Controller Inc., a data analyses firm that monitors refrigeration and HVAC equipment, also had PPP loans granted through SVB, according to SBA records.

Reddress and Polar Controller did not immediately respond for a request for comment.

What’s Next

As far as SVB and Signature being bellwethers for impending financial doom, many local experts are skeptical that the impacts will ripple through the banking sector.

“These recent bank closures were aberrational when compared with failures beginning in 2008 running through 2010 where bad real estate loans caused 95% of the failures,” said Bill Nicholson, principal and chief compliance officer at Jacksonville-based advisory firm Heritage Capital Group. “SVB and Signature were specialized lenders with VC and crypto loans along with a unique client and depositor base; liquidity, asset/liability mismanagement and deposit withdrawals were the primary causes.”

He added that the impacted institutions, at least thus far, have been relegated to banks he said engaged in more risky behavior.

“Venture capital investment has always been deemed high risk,” he said. “Most banks won’t touch venture capital lending. Unlike the prior crisis 14 years ago, my experience with our local, regional and money center banks suggests an appropriate risk/return approach to their lending.”

This isn’t the same situation as 2008, said Sean Snaith, the director of the University of Central Florida’s Institute for Economic Forecasting

“Unlike the 2008 crisis, which was a result of bad mortgage loans that much of the banking system had some degree of exposure to, SVB seems to be a case study of poor management of assets in an environment of rising interest rates,” he said.

SVB saw explosive growth in assets from $60 billion to $200 billion-plus in just two years and had to do something with this money. They put a significant portion into bonds — creating a problem when interest rates rose, making those bonds worth less.

“The environment of rising interest rates was not some black-swan event that nobody saw coming,”Snaith said, “so it is beyond puzzling that the bank did not hedge against this risk or that its regulators didn’t raise a red flag over it.”